“My USC experiences and mentors enhanced both my technical and soft skills, priming me for my professional career. Their impact on me, professionally and personally, is priceless.”

We are transforming the face of pharmacy by leading the convergence of science, healthcare and policy.

Since our founding in 1905, the school has fueled pioneering initiatives in research, education and practice while fostering new generations of leaders. Our impact includes groundbreaking laboratory discoveries, novel regulatory approaches, meaningful health policy reforms, and transformative collaborations in medication management and chronic disease prevention. Curricular advances include launching the first PharmD, regulatory science doctorate and healthcare decision analysis programs, among many others.

The moment you join the school, you become part of the renowned Trojan Family—a vast, supportive international network. Our alumni hold leadership roles at major pharmaceutical companies, government agencies, top medical centers, NASA and Jet Propulsion Lab, and many other dynamic environments—and are dedicated to helping USC students and fellow graduates. We give you a world of opportunity.

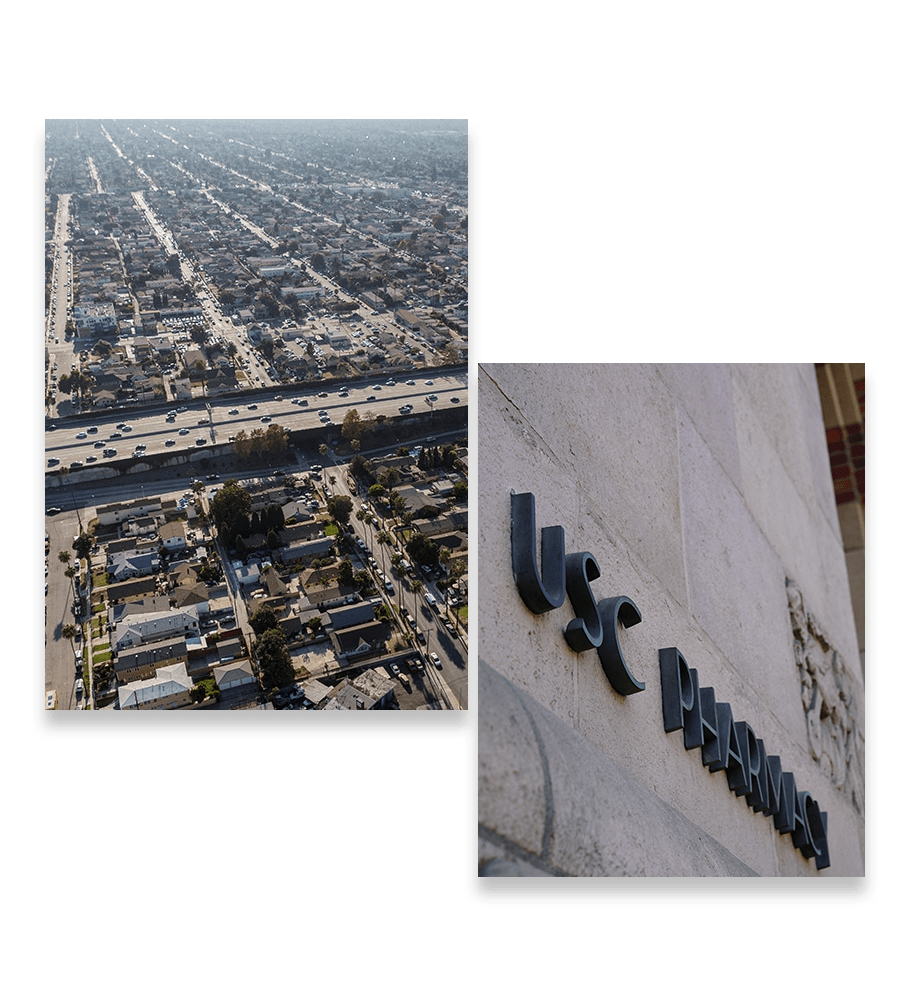

Through health fairs, community clinic partnerships, public health campaigns and unparalleled collaborations to manage chronic disease, the school’s students, faculty and alumni demonstrate an ongoing commitment to improving the health of the community we serve. And through our Science, Technology and Research (STAR) program, we help new generations of underrepresented high school students pursue careers in the life sciences.

Our programs span the entire pharmaceutical continuum—from discovery and development to regulation and from translation to patient care and outcomes.

Soon after Vassilios Papadopoulos became dean of the USC School of Pharmacy in October 2016, he approached Raffi Svadjian, executive director of community pharmacies, with a bold idea. What about launching a new pharmacy in South Los Angeles, an underserved area for pharmaceutical care?

#1

Private

Pharmacy School

20

Different Degree

Programs

#1

Private

Pharmacy School

20

Different Degree

Programs

#1

Private

Pharmacy School

20

Different Degree

Programs

Our location on a major academic medical center campus in the heart of a vibrant city offers extraordinary opportunities for internships, community engagement and mentoring. With 140 countries represented and 224 languages spoken, Los Angeles is filled with diverse cuisine, cultural institutions and recreational offerings. L.A. is home to more theaters, music venues and museums than any other U.S. city, and you can ski, hike and surf in nearby beaches and mountains.

Events

Thursday April 25, 2024

Sunday April 28, 2024

Thursday May 2, 2024

“My USC experiences and mentors enhanced both my technical and soft skills, priming me for my professional career. Their impact on me, professionally and personally, is priceless.”

“My experiences at USC equipped me with the leadership and clinical skills to propel my career. The lifelong friends and colleagues I made continue to show up in my personal and professional life.”

“The scholastic discipline instilled at USC was instrumental in forging my career. Always think of patients first—but with a commercial hat on as well. [The Trojan Family] is a connection that’s always there, and comes into light in the strangest of places and the most fanciful of situations.”

“The rigorous training I received through the USC Pharmaceutical Sciences PhD program equipped me with a strong foundation in natural product chemistry, microbial genetics and analytical chemistry. This comprehensive background has proven invaluable in my research on unraveling the molecular mechanisms underlying microbe-host interactions.”